Relative value of USD vs. EUR credit

Year-to-date, EUR credit has significantly outperformed its USD counterpart. What explains this divergence in performance?

It is certainly not due to the fundamentals of European banks (Q4’24 earnings were solid), with no surprises from a credit perspective. Instead, the underperformance of USD credit is largely sentiment-driven, with issuance volume playing a key role in the discrepancy.

Another crucial factor is the relative outperformance of US rates compared to European (particularly German) rates, with the Z-spread adjustment in the USD market lagging behind. This dynamic has further contributed to the performance gap between EUR and USD credit.

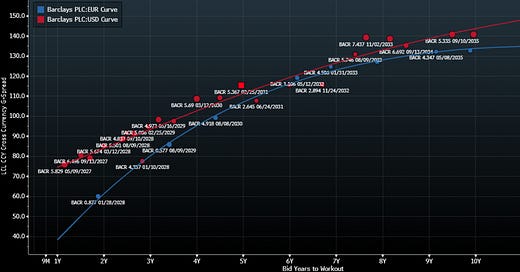

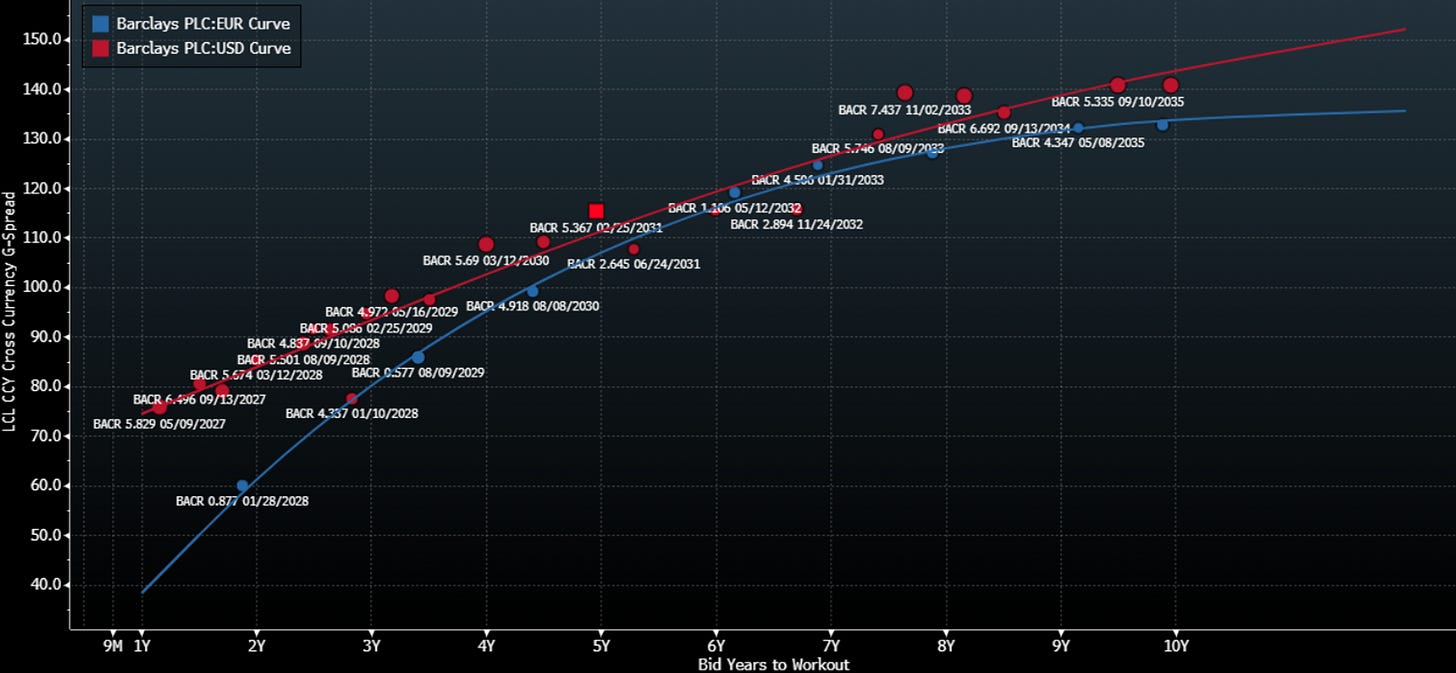

Given these conditions, we see compelling trading opportunities in switching from EUR to USD along the curve of large, liquid issuers that maintain deep markets in both currencies.

Keep reading with a 7-day free trial

Subscribe to Yaru Investments Substack to keep reading this post and get 7 days of free access to the full post archives.